Protected deposit in Turkey for Turkish Citizenship

2022

16 Aug

What is a protected deposit in Turkey?

The protected deposit in Turkey is an innovative idea. The Turkish Central Bank imposed a financial protection system on depositors' money, ensuring that these depositors maintain their capital deposited in Turkish lira in the face of exchange rate fluctuations in the currency market.

The idea of approving a protected bank deposit, or what is known as the protected lira, arose with the aim of encouraging Turkish citizens and other foreigners to deposit their money in the Turkish lira while giving them some advantages that would increase their confidence factor to prevent the reluctance of investors affected by fear of fluctuations in the exchange operations of the Turkish lira.

So, the protected deposit (or what has come to be known as YUVAM) is a financial mechanism launched by Turkey in late 2021, which guarantees Turkish lira depositors not to fall victim to exchange rate fluctuations, and to obtain the declared interest, in addition to the difference with the dollar exchange rate between the time of deposit and withdrawal.

The YUVAM Program is an economic program launched by the Turkish government to encourage savings in local currency in Turkish banks. It is intended for foreigners and expatriate Turks, whether companies or individuals while ensuring that the value of the saved money is protected from emergency exchange rate fluctuations in the markets against foreign currencies. The additional return is a profit margin, with a minimum of 3% per annum.

Law of obtaining Turkish citizenship in exchange for a bank deposit

The beginning was with the investment law, which made it possible to apply for Turkish citizenship in return for a range of types of investments, including a bank deposit, worth $3 million. Then came the successive law amendments that reduced the types of investment in exchange for Turkish citizenship, and also included the amount specified for obtaining Turkish citizenship in exchange for a bank deposit, of course.

As the minimum deposit amount in one of the accounts of Turkish banks was modified to $500,000, or its equivalent in other currencies, instead of $3 million, with a pledge not to withdraw the deposited amount for a period of no less than three years as a limit. lower than the date of application.

Does the protected deposit in Turkey apply to the Turkish Nationality Law in exchange for a bank deposit?

There is no doubt that the exchange rate fluctuation of the Turkish lira would constitute a concern that calls to ask investors about the fate of their money deposited with the aim of obtaining Turkish citizenship through a bank deposit, especially since the deposit has a specific time, so the depositor with the aim of acquiring Turkish citizenship is not entitled to withdraw any amounts from this deposit or disposal of it, which may cause losses to the deposit, especially since it is required that these amounts be deposited in Turkish lira.

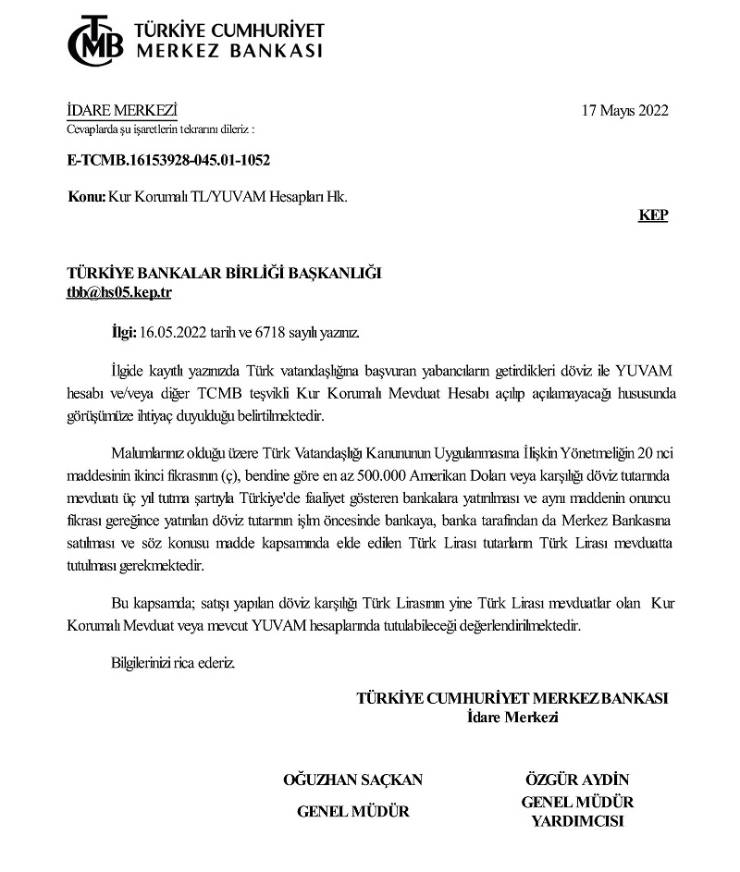

In this regard, the Central Bank of Turkey recently issued a decision on 17/5/2022 to protect the deposits of foreign depositors or expatriate Turks against exchange rate fluctuations in the market, which has already been implemented on the ground by some banks operating in Turkey.

As it was stated in the aforementioned decision: “The money deposited in Turkish lira for this purpose (ie, the purpose of obtaining Turkish citizenship) is subject to one of the two systems for protecting the Turkish lira from currency exchange fluctuations in force.”

It solves the most important and biggest problem in this regard, especially after pledging this guarantee on investors' deposits, similar to the YUVAM decision that was previously discussed in the previous paragraph.

How does Gars Company guarantee the refund of the same value of your money when obtaining Turkish citizenship by way of a deposit?

Gars Consulting Company, through its highly experienced legal team, which includes elite Turkish and Arab lawyers, ensures that all legal procedures are facilitated, and all obstacles are removed for foreign investors wishing to obtain Turkish citizenship through bank deposit.

Given our extensive experience in the field of financial and legal services and our close association with some Turkish banks, we can guarantee the possibility of fixing their deposits in a financial system protected in accordance with legal principles. For more detailed information, we recommend you to contact our legal advisor at Gars Consulting Company.

Edited by Gars Consulting Company ©For you